Intelligent

Investment Pieces

Learn about key pieces of the investment puzzle and simplify the unnecessarily complex world of investing.

The Irrefutable Power of Equities - 6 of 6

A Lesson on Equities

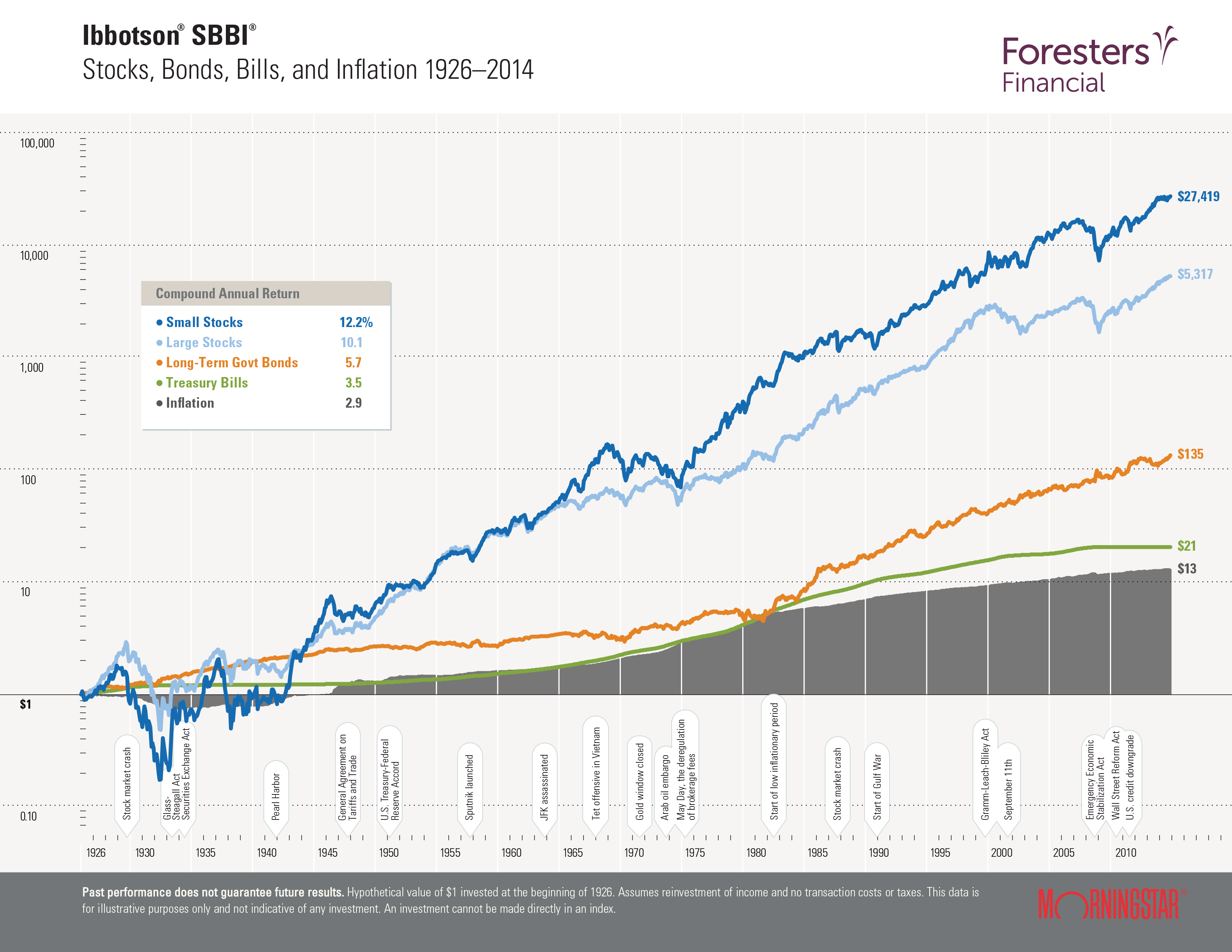

The following chart from Ibbotson & Associates and Morningstar, independent asset allocation and research firms, summarized USA asset class (i.e., stocks versus bonds) returns between 1926 and 2014 as follows:

Canadian market returns show similar but slightly lower returns.

The chart indicates that a $1 investment in large-capitalization stocks (with a market capitalization of more than $5 billion, i.e., Apple, RBC or Nestle) in 1926 would have grown to $5,317 by 2014. A similar $1 invested in long-term government bonds in 1926 would have grown to only $135 by 2014.

Large-cap stocks did 39 times better than long-term government bonds!

Other lessons from this chart

Small-capitalization stocks (with a market capitalization between $300 million and $2 billion) did even better than large-cap stocks, growing to $27,419 by 2014, and clearly illustrates the importance of only a small increment in the average long-term return (and also explains why financial advisor fees of only 2% can be so very harmful to a long-term investor).

The time period in the chart above includes the Great Depression, World War II, the JFK assassination, 9/11, and the financial crisis. In other words, there have been multiple times throughout this 88-year history of investing in which people have said “sell” or “this time is different.” But if you stayed invested long-term, i.e., 10, 20 or more years, you got rewarded. Again, in case you missed it, successful investors are disciplined, long-term investors who don’t get caught up into day to day swings in the market.

Also notice that, at the start of the chart, there is huge volatility within and between asset classes. Importantly, the longer you stay invested in equities, equities’ clear dominance becomes irrefutable. With equities, you should expect huge volatility during your first five to ten years of investing; thereafter, equities’ long-term average returns will start to take effect. Don’t sell during this expected volatility; if anything, try to invest a bit more when the market has a big drop, and equities go “on sale.” Remember, it feels better to buy that pair of shoes you have been coveting when they go on sale.

Remember when you invest in equities, poop / volatility happens, but stay the course long term, and you will leverage the irrefutable power of equities.

"The four most expensive words in the English language are 'This time it's different." - John Templeton

"Buy when everyone else is selling and hold until everyone else is buying. That’s not just a catchy slogan. It’s the very essence of successful investing." - J. Paul Getty