TheAnswerIs.ca

Model Portfolio

TheAnswerIs.ca Inc. Model Portfolio Performance Update (Q3 2021)

TheAnswerIs.ca Inc. announces a total return for the Model Portfolio from inception October 26, 2016, to September 30, 2021 of 63.16%.

The corresponding total return for the Toronto Stock Exchange (TSX), as represented by the ETF XIC, is 57.30%. TheAnswerIs.ca Model Portfolio return is higher than the TSX return, due to its broader economic sector diversification.

The annualized return for the TheAnswerIs.ca Model Portfolio for the 4.93 years since inception is 10.44% per year.

The trailing 3-month total return for TheAnswerIs.ca Model Portfolio was negative .28%. The trailing 12-month total return for TheAnswerIs.ca Model Portfolio is 25.28%.

Past returns are not indicative of future returns.

Due to the onset of COVID, between February 20, 2020, and March 23, 2020, the TSX, (and most global stock markets), dropped by approximately 35%. Yes, a drop of 35% in just over one month. Since then, the TSX has rebounded and is now even higher than it was prior to COVID.

The lesson here is that volatility works both ways, up and down. Volatility can "feel" bad when the market is dropping, but if one can manage their emotions and buy equities in a downturn rather than sell, volatility can become your friend.

Global stock markets are now near their all-time highs. In other words, in the history of the world, stock markets have never ever been this high. That does not mean they are about to drop. Stock markets tend to rise “farther than they should”, and also fall “further than they should”, reflecting human greed and fear, respectively.

I have no idea if the stock market will be higher or lower in the short term, and quite frankly no one else does either. However, it is likely that in the long term, i.e., 10 years or longer, global stock markets will be higher than they are today.

Having said that, the potential for huge gains over the short term appear somewhat limited due to the stock markets current high price level.

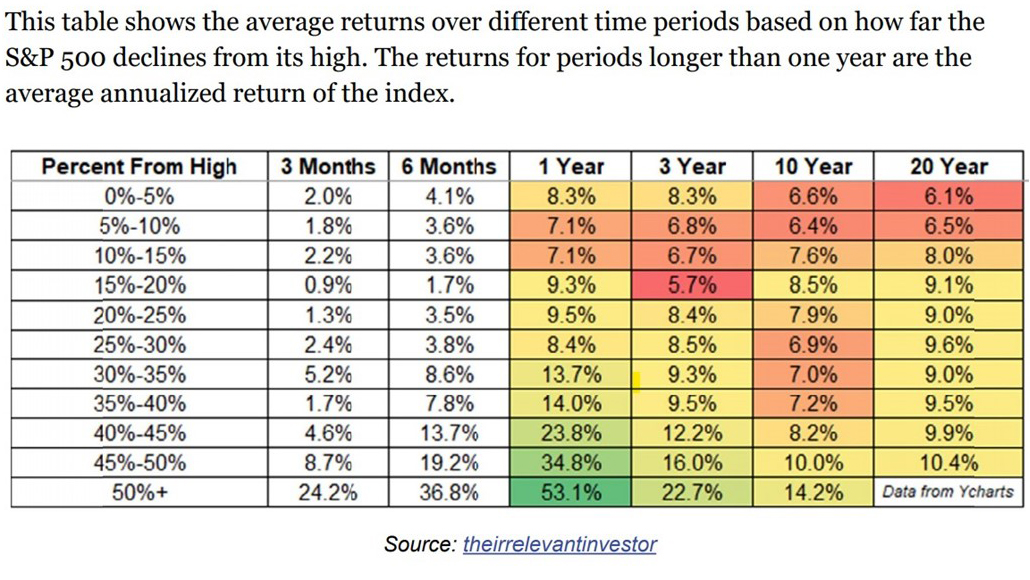

Today the S&P 500 is about 5% less than its all-time high, therefore, based on history, one might expect a one-year return of about 8.3%. Compare that to March 2020, when the S&P 500 was approximately 35% off its peak, one may have reasonably expected a higher one-year return of 13.7%. Longer term, i.e., 20-year returns, are also impacted by the current high level of global stock markets. It is interesting to note that notwithstanding today’s high price level, one may still expect a 20-year average annual return of 6.1% – not bad compared to current fixed income alternatives.

The key to investment success is to make sure any money invested in the stock market can be left untouched for a minimum of 10 years, and preferably much longer. Not selling into a stock market downturn will ensure time for a portfolio to recover and provide potentially attractive long-term average equity returns. Five years before one slows down working, and begins to draw money from their portfolio, one should move a significant portion of their portfolio into Fixed Income.

Annual Rebalancing TheAnswerIs.ca Model Portfolio

TheAnswerIs.ca Model Portfolio comprises six ETFs, (to see the Model Portfolio take the Ready to Invest quiz on the website https://theansweris.ca/profile.php ).

The AnswerIs.ca Model Portfolio is rebalanced once per year in October.

Over the course of the year the Model Portfolio accumulates cash from the ETF dividends / distributions. Further, some ETFs perform better than others.

To invest the dividend income accumulated throughout the year and to rebalance the Model Portfolio, we need to buy more of the ETFs that have not performed well, and sell some of the ETF’s that have performed comparatively well. It may seem counter intuitive to sell a portion of the “winners”, and buy more of the “losers”, but in effect, this process ensures selling at high ETF prices and buying at low ETF prices.

Overall, TheAnswerIs.ca model portfolio was up 25.28% over the last year. All six ETFs were higher, up by between 7% and 33%. The two worst performing ETFs were Utilities and Emerging Markets, up by only 7% and 10% respectively. The best performing ETF, up 33%, was Real Estate, (which happened to be the worst performer last year, and as a result, we used most of last years dividend income to buy XRE last year, which happened to work out very nicely 😊). The remaining three ETFs were all up between 24% to 28%.

To rebalance, (Login and go to Add Money / Rebalancing Tab) we simply insert the current portfolio value in the space provided and follow the instructions to rebalance. As a result, we sold a small amount of the Real Estate ETF that did comparatively well, and purchased more of ETFs that did comparatively poorly over the last year, i.e. Utilities and Emerging Markets.

That’s it, time to put TheAnswerIs.ca Model Portfolio on cruise control until next October!

Invest long-term and prosper.