Is an All-Equity Portfolio

DiWORSEification?

Some people call me left brained, analytical and methodical. My eldest daughter is right brained, creative and unpredictable.

On a summer trip to the cottage, my eldest daughter and I were ripping down a narrow paved two-lane country road with corn fields on both sides. There was a large black bird proudly standing on the dirt shoulder as we roared by.

I looked back in my mirror and the large black bird had not moved an inch. "What a stupid crow," I said.

My daughter immediately shot back, "No, that's a brave crow."

I love that. Two people see the exact same set of facts but arrive at different conclusions.

This dichotomy happened again as I read The Globe and Mail on January 17, 2023. There was an article written by Mr. David Rosenberg, a well-regarded economist with an impeccable resume that I respect tremendously. I love attending his talks and reading his articles.

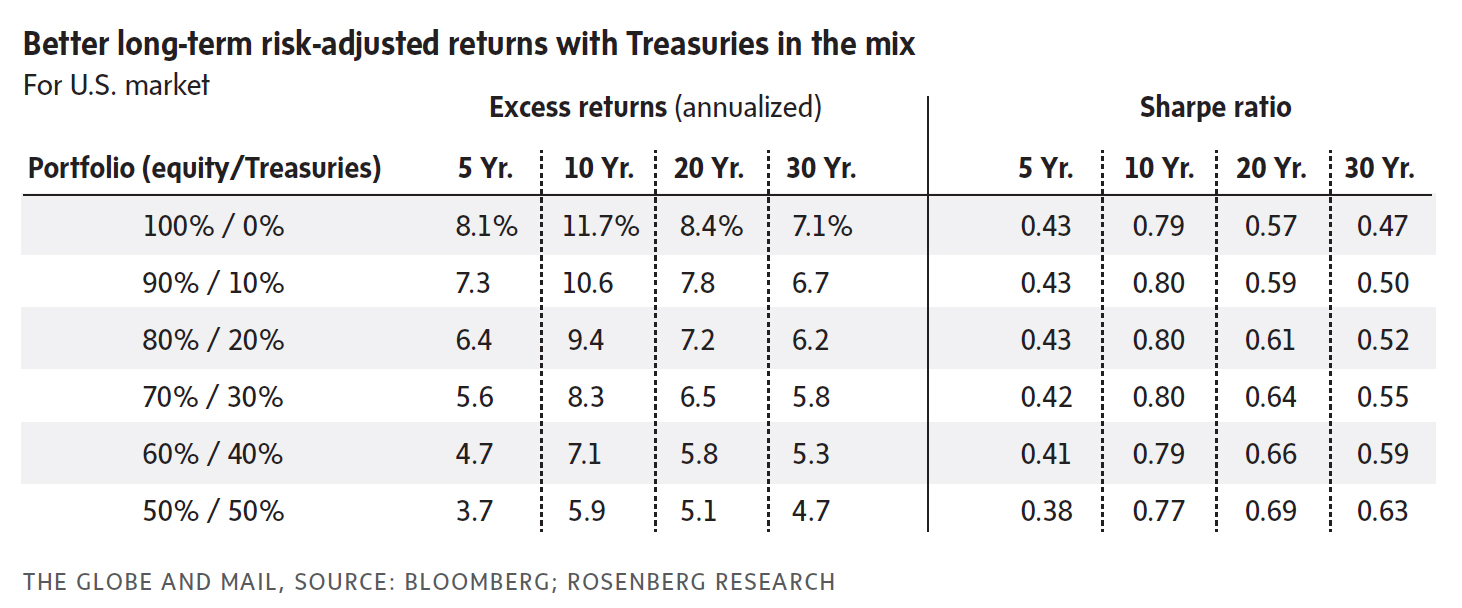

The data in the table below summarizes "excess returns," (i.e., returns in excess of Treasury-only returns), and Sharpe ratios for various stock/Treasury bond portfolio compositions. Mr. Rosenberg looked at the set of facts below and concluded with the headline, "Diversification never really goes out of style."

Mr. Rosenberg’s conclusion is based on the premise that some bond exposure in a portfolio provides superior risk-adjusted returns, as measured by the Sharpe ratio. Mr. Rosenberg states that diversification is a prudent risk management strategy, notwithstanding the reality that overall expected returns are far lower today than they have been historically.

I looked at the table and arrived at the opposite conclusion. Generating low returns by purposefully introducing bond diversification is the worst thing a disciplined young investor can do. Lost returns compound into a very large mistake 10, 20 and 30 years down the road.

Mr. Rosenberg states, “The fact is that successful investors do not just focus on potential returns, but also the need to protect capital and manage their downside risk.” This statement makes perfect sense for middle-aged and older investors who may need to draw on their portfolio within the next five or ten years, but it’s expensive mistake for young investors with 20, 30 or more years left to invest. Young investors who seek to reduce – but can never eliminate – volatility by forgoing equity-only returns pay an extraordinarily high price – as much as 50% of their long-term portfolio value. This is the Cost of Playing it Safe.

Uh-oh, now what do I do? Dare I write an article disagreeing with the likes of Mr. Rosenberg?

Well, I come from the school of thought that says two people can discuss a common set of facts and have different opinions without having to offend each other.

An important factor impacting my opinion is that I am SOLELY focused on the perspective of young people who are prepared to invest for the long run of 10 years or more. While there are merits to the arguments made by Mr. Rosenberg, his article, and other similar ones, are written for older audiences with different objectives. Nonetheless, the TIMING of introducing diversification into a portfolio is an important discussion, as young people require different advice than older investors.

Let me step back for a moment.

Young people have a much different and more challenging investment environment today and, in many ways, are disadvantaged relative to my Boomer generation.

A major contributor to this disadvantage has been the extended period of low interest rates which has pushed housing prices to all-time highs, compromising housing affordability. Artificially inexpensive capital also caused a misallocation of investment resources, impeding productive investment, thereby jeopardizing our nation’s prosperity, negatively impacting young people the most. Not to mention the billions in debt we have added to all levels of government, which limits future government investment in health care, education, climate change, and our ability to respond to future national emergencies.

In my view, the ONLY way young people can overcome the disadvantaged position that Boomers have bestowed on them is by investing DIFFERENTLY.

"Differently" means investing ONLY in an all-equity portfolio and ONLY investing money that can remain untouched for a minimum of 10 years, preferably much longer.

The incremental return of an all-equity portfolio compared to a diversified portfolio of stocks and bonds will allow young people to claw back a HUGE portion of the economic disadvantage that Boomers served up to them.

Let’s discuss Mr. Rosenberg’s table.

The Sharpe Ratio measures risk-adjusted returns, i.e., the excess returns over and above the risk-free rate (in this case provided by short-term Treasuries/bonds), that a portfolio generates per unit of volatility. Simply put, a higher Sharpe Ratio is better, as it means that a portfolio is generating more return per unit of volatility.

This can be a fuzzy topic.

Generally, higher returns are associated with higher risk, but by introducing a mix of Treasuries, (i.e. bonds), into a portfolio, investors acknowledge that they will give up some returns to experience a reduction in volatility. For a Boomer investor who has historically benefited from a more favourable investing environment, portfolio diversification, (i.e., a mix of equities and bonds) can improve their risk-adjusted returns, i.e., generate lower volatility with lower returns.

However, one size of "diversification" does NOT fit all.

Younger investors cannot afford to give up the excess returns from an all-equity portfolio to enjoy less-volatile returns. It is in the best interest of young investors to LEARN TO LIVE with the higher volatility of an all-equity portfolio to earn the extra returns it can generate.

Learning to live with higher volatility is NOT COMPLICATED. Only invest money in an all-equity portfolio that you can afford to leave alone for a minimum of 10 years, preferably longer, and NEVER sell your equities in a downturn. That’s it.

In the article, Mr. Rosenberg writes "a blend of 50 percent equities and 50 percent Treasuries scored better in terms of delivering risk-adjusted total returns."

Below, we’ll compare the returns and Sharpe Ratios of an all-equity portfolio versus a 50% stock and 50% Treasury diversified portfolio over 10-, 20-, and 30-year periods.

A couple of observations from the data in the table shown above:

An all-equity portfolio offers much higher excess returns over ALL time frames.

The data also shows that an all-equity portfolio offers a slightly higher Sharpe Ratio over five and 10- year time periods. That means higher returns and also slightly better risk-adjusted return performance.

For the 20- and 30-year time periods, a 50% stock and 50% Treasury portfolio does indeed yield better Sharpe Ratios, which means a diversified investor portfolio will be less volatile than an all-equity portfolio, but at what cost in terms of compounding potential and resultant future portfolio value, especially for young investors?

I always say that no investor should entertain an all-equity portfolio unless they are willing to leave the money untouched for a minimum of 10 years, preferably longer. About five years before an investor needs to draw on their portfolio, they can diversify by incorporating a large portion of fixed income. Since young investors have longer-than-average investment horizons, I have focused my analysis assuming a hypothetical annual savings of $10,000 over a 10-, 20-, and 30-year timeframe.

If a young investor adopts an all-equity portfolio, their resulting portfolio values, compared to a diversified portfolio of 50% stock and 50% Treasuries, are as follows:

| All-Equity Portfolio | Diversified Portfolio | All-Equity Portfolio Benefit | |

|---|---|---|---|

| 10 Years | $172,962 | $131,191 | $41,771 (32% more) |

| 20 Years | $478,410 | $334,176 | $144,234 (43% more) |

| 30 Years | $961,775 | $631,157 | $330,618 (52% more) |

Note: Dollar amounts shown above represent only an analysis of excess returns defined above – using historically average nominal all-equity returns would result in a larger all-equity portfolio benefit.

In a nutshell, over a 30-year period, an all-equity portfolio can generate $330,618, i.e. 52% , more in wealth compared to a diversified portfolio of 50% equity and 50% bonds.

Some financial writers argue that diversification is "safer" than an all-equity portfolio, especially for newbie young investors.

But "safer" by definition means less volatility AND lower returns. Isn’t there actually a HIGHER RISK that young investors will NOT achieve their retirement portfolio value goals if they start their investment journey with a diversified portfolio?

Boomers benefited from a more favourable investing environment and therefore had the good fortune of being able to accept lower returns and preach about the merits of lower volatility through a diversified portfolio.

As I mentioned earlier, Boomers need to remember we dealt young investors a bad hand. The only thing a young investor can do is to play the cards they were dealt, the BEST they can. That means LEARNING TO LIVE WITH VOLATILITY to capture the higher returns an all-equity portfolio offers, clawing back some of the disadvantage they inherited.

To be clear, a young investor with a long investment horizon should seek out higher returns and be less concerned with temporary volatility. If any investor, young or old, needs money in the near term to pay for a wedding, car, house down payment, etc., they should NOT draw these short-term funds from their all-equity portfolio. Better alternatives to meet shorter-term goals are high-interest bank accounts, Guaranteed Investment Certificates (GICs), or short-term bond ETFs.

Many young Canadians would benefit if Mr. Rosenberg and other financial writers clearly advocated for the benefits of an all-equity portfolio for young investors and encourage them to live with higher volatility so they can benefit from higher returns long-term.

If young people with long investment horizons can be coached to be more disciplined, i.e., learn to live with volatility, they will at least have a chance of obtaining portfolio values that us Boomers were able to take for granted, albeit they will have to live without the smoother ride afforded by diversification.

I have the utmost respect for Mr. Rosenberg and hope he will still let me attend his talks. But I would also love his help to promote all-equity portfolios for young people so they can reach their financial goals.

Was that large black bird on the shoulder of the road stupid, or brave?

Is an all-equity portfolio DiWORSEification, or the strategy that assists young investors achieve their long-term investing goals?

Invest long-term and prosper.

Investing in All-Equity ETFs is now one-click simple. Read more: